In the previous blog on blackwood prices I discussed some of the issues around blackwood pricing and markets using an actual blackwood price list “from hell”.

https://blackwoodgrowers.com.au/2015/10/19/blackwood-pricing-and-the-forest-industry-1/

Here I present some better examples of timber price lists including another real blackwood price list, but this one should definitely stir some interest from existing and potential growers.

This retail blackwood price list exhibits both excellent overall prices from a grower and sawmillers viewpoint, but also includes allowance for the cost of time it takes to grow bigger trees to produce the larger size boards. Hence the 5.8% “step-up” in the price per cubic metre for the 38mm and 50mm thick boards. I’m assuming of course that this pricing structure reflects in some degree what was paid to the growers, with larger logs attracting better prices than smaller logs.

Remember that Tasmanian blackwood is Australia’s premium appearance grade timber species.

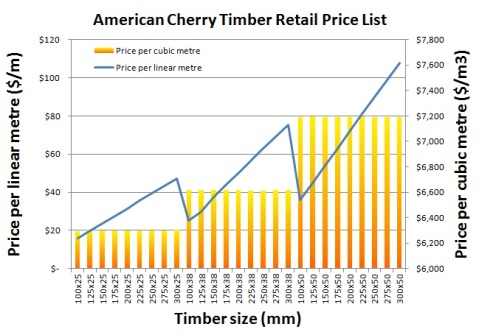

By way of comparison here is a price list for American Cherry (Prunus serotina) from the same retailer. American Cherry is regarded as the number one premium appearance timber in the USA. Almost all American Cherry is grown in native forest by a vast number of small private forest growers, so the markets are very competitive. These prices therefore are likely to accurately reflect real market conditions, including grower profitability. The same certainly can’t be said for Tasmanian blackwood.

I’ve made both the blackwood and the cherry charts are on the same scales to allow for easy comparison.

Notice the cherry price list has two step-ups in the cubic metre price (4.9 and 8.8%, with the over increase of 14.1%) to reflect the three timber thickness grades, and the cost of time needed to grow larger trees to produce the bigger boards.

By way of comparison Premium clear grade Radiata pine retails for about $2,500 per cubic metre.

So if retailers and sawmillers (but not the growers) are making money selling blackwood at $2,500 per cubic metre, surely at $7,000+ per cubic metre there is plenty of potential for growers to be rewarded sufficiently to consider commercial blackwood as a profitable investment.

Much more than any other primary industry, forestry relies upon growers getting a fair deal and a good price, otherwise the forest industry has no future. A 30+ year investment to grow trees involves an exceptional amount of goodwill, trust and fair play in the marketplace. So far the forest industry does not have a good reputation in this regard.

The only other option is for growers to do the harvesting, sawmilling, and selling themselves. A Growers Cooperative then becomes the natural result of this outcome. But this still requires the marketplace to provide price and demand signals.

Both the blackwood and cherry price lists potentially provide incentive and reward/profit to forest growers to produce these beautiful premium timbers, as well as recognise and encourage the growing of large trees to produce the large wide boards that the market demands. These are the just rewards of time, patience, good forest/plantation management and a forest industry/marketplace working together to build a future.

The private American Cherry growers keep managing their native forest and growing and selling their Cherry timber.

But what about the growers of Tasmanian blackwood?

It is an interesting footnote that Tasmanian taxpayers pay to have public native blackwood forest logged (Forestry Tasmania deliberately makes a loss) in order that approximately $40,000,000 worth of blackwood timber and veneer is sold every year. Why does blackwood need to be subsidised?

Blackwood pricing and the forest industry #2

In the previous blog on blackwood prices I discussed some of the issues around blackwood pricing and markets using an actual blackwood price list “from hell”.

https://blackwoodgrowers.com.au/2015/10/19/blackwood-pricing-and-the-forest-industry-1/

Here I present some better examples of timber price lists including another real blackwood price list, but this one should definitely stir some interest from existing and potential growers.

This retail blackwood price list exhibits both excellent overall prices from a grower and sawmillers viewpoint, but also includes allowance for the cost of time it takes to grow bigger trees to produce the larger size boards. Hence the 5.8% “step-up” in the price per cubic metre for the 38mm and 50mm thick boards. I’m assuming of course that this pricing structure reflects in some degree what was paid to the growers, with larger logs attracting better prices than smaller logs.

Remember that Tasmanian blackwood is Australia’s premium appearance grade timber species.

By way of comparison here is a price list for American Cherry (Prunus serotina) from the same retailer. American Cherry is regarded as the number one premium appearance timber in the USA. Almost all American Cherry is grown in native forest by a vast number of small private forest growers, so the markets are very competitive. These prices therefore are likely to accurately reflect real market conditions, including grower profitability. The same certainly can’t be said for Tasmanian blackwood.

I’ve made both the blackwood and the cherry charts are on the same scales to allow for easy comparison.

Notice the cherry price list has two step-ups in the cubic metre price (4.9 and 8.8%, with the over increase of 14.1%) to reflect the three timber thickness grades, and the cost of time needed to grow larger trees to produce the bigger boards.

By way of comparison Premium clear grade Radiata pine retails for about $2,500 per cubic metre.

So if retailers and sawmillers (but not the growers) are making money selling blackwood at $2,500 per cubic metre, surely at $7,000+ per cubic metre there is plenty of potential for growers to be rewarded sufficiently to consider commercial blackwood as a profitable investment.

Much more than any other primary industry, forestry relies upon growers getting a fair deal and a good price, otherwise the forest industry has no future. A 30+ year investment to grow trees involves an exceptional amount of goodwill, trust and fair play in the marketplace. So far the forest industry does not have a good reputation in this regard.

The only other option is for growers to do the harvesting, sawmilling, and selling themselves. A Growers Cooperative then becomes the natural result of this outcome. But this still requires the marketplace to provide price and demand signals.

Both the blackwood and cherry price lists potentially provide incentive and reward/profit to forest growers to produce these beautiful premium timbers, as well as recognise and encourage the growing of large trees to produce the large wide boards that the market demands. These are the just rewards of time, patience, good forest/plantation management and a forest industry/marketplace working together to build a future.

The private American Cherry growers keep managing their native forest and growing and selling their Cherry timber.

But what about the growers of Tasmanian blackwood?

It is an interesting footnote that Tasmanian taxpayers pay to have public native blackwood forest logged (Forestry Tasmania deliberately makes a loss) in order that approximately $40,000,000 worth of blackwood timber and veneer is sold every year. Why does blackwood need to be subsidised?

Share this:

Like this:

Related

FOLLOW BLOG VIA EMAIL

FOLLOW BLOG VIA EMAIL

Categories