IST Tender Results 2020-21

Island Specialty Timbers (IST), the only source of competitive, transparent market blackwood log prices, conducted 10 log tenders during the year, making up for the shortfall last year due to the pandemic.

https://www.islandspecialtytimbers.com.au/

IST is a business enterprise of Sustainable Timber Tasmania (STT) which sources and retails raw material of Tasmanian specialty timbers from harvest or salvage operations conducted on State owned Permanent Timber Production Zone land (PTPZl).

You can read my previous annual tender summaries here:

https://blackwoodgrowers.com.au/?s=tender

Blackwood Results

2021 was a champagne year for blackwood!

2021 was the year that plain-grain blackwood sawlog broke the $1,000 per cubic metre price barrier!

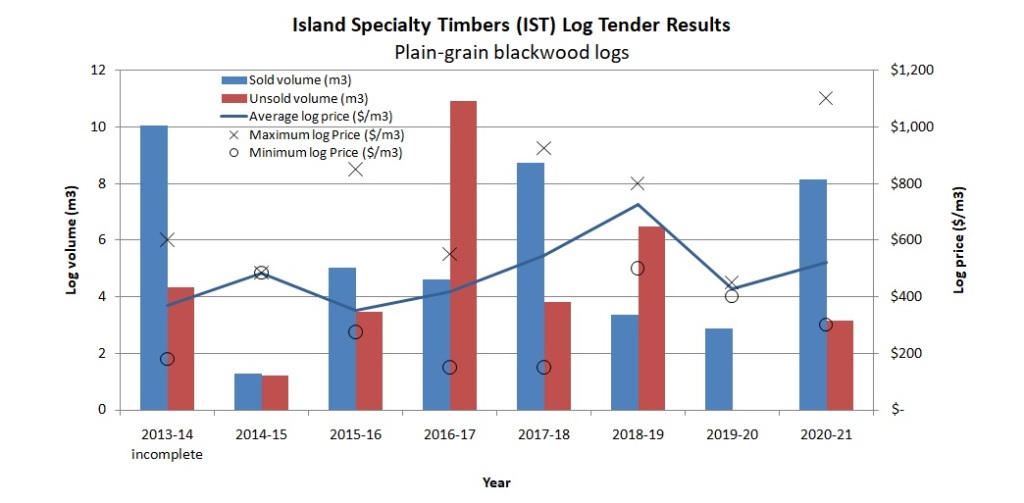

Prices for good quality plain grain blackwood sawlogs have been sitting above $800 per cubic metres for the last few years, as seen in the chart below, but this year they broke through the price ceiling.

Premium plain grain sawlogs are what can be grown in blackwood plantations.

Will this result encourage Sustainable Timbers Tasmania/IST to put more blackwood sawlogs to tender?

Will this result capture the attention and imagination of Tasmanian farmers?

This year IST put 10 blackwood logs to tender, a total of 11.9 cubic metres, or 4.4% of the total volume put to tender for the year.

One log was unsold at tender, as was a 2 cubic metre pack of sawn blackwood boards.

Two logs had feature grain and sold between $1,250 and $1,300 per cubic metre.

The other 7 logs were plain grain, with prices ranging from $300 to $1,100 per cubic metre. Lower prices were paid for smaller logs and logs with defects (spiral grain, scars, branch knots).

Higher prices were paid for large, good quality logs.

All up the 8.14 cubic metres of plain grain blackwood logs sold for $4,259.

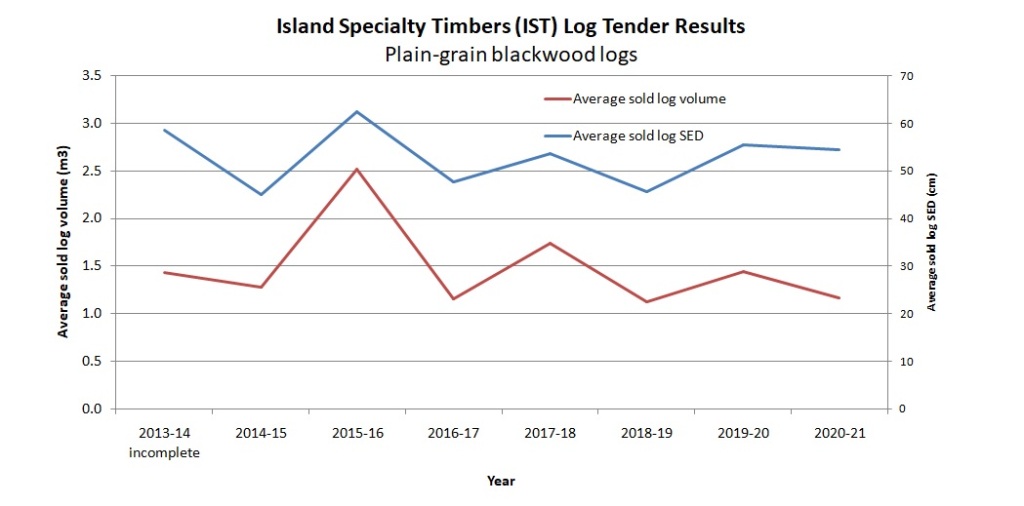

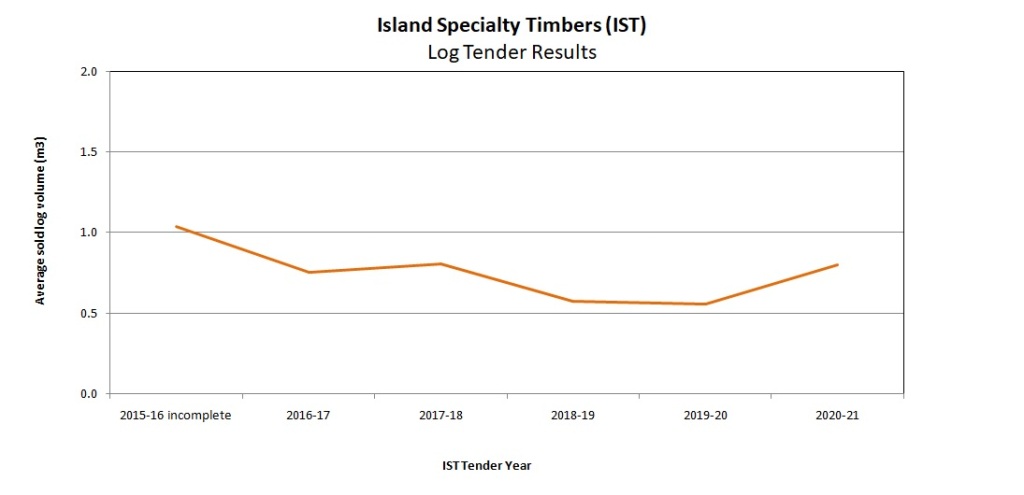

The following chart shows the average size characteristics of sold plain grain blackwood logs. The target sawlog for a blackwood plantation has a volume of 1.5 cubic metres and a small end diameter (SED) of around 50 cm.

Remember these are tiny log volumes sold into the small southern Tasmanian market. They represent mill door prices not stumpages.

As usual IST has a policy of minimising the amount of blackwood logs it puts to tender, despite the fact that around 10,000 cubic metres of blackwood are harvested from public native forests in Tasmania each year, and sold at “Government prices”.

Imagine if IST put 10 cubic metres of blackwood sawlog at each tender, to attract mainland and maybe even overseas buyers.

Imagine if Government forest policy was about profitable tree growers and not sawmill welfare.

Imagine what that change would do for the forest industry and Tasmania!

These positive blackwood log price signals should be resulting in more blackwood plantations being established, helping to build the industry and make Tasmanian farmers more profitable.

One hectare of well managed blackwood plantation has the potential to produce approx 300 cubic metres of premium sawlog after 30 – 35 years. At $1,000 per cubic metre that equates to $300,000 per ha in todays market.

How many Tasmanian farms have difficult corners, steep slopes and weedy areas that could be more productive growing quality wood?

General Results

Overall IST put 272 cubic metres of specialty timbers to tender in 2020-21 of which 252 cubic metres sold for total revenue of $262,700.

Last year Sustainable Timbers Tasmania sold 7,921 cubic metres of specialty timbers, so these competitive tender sales represent a mere 3% of specialty timber sales from public native forests in Tasmania.

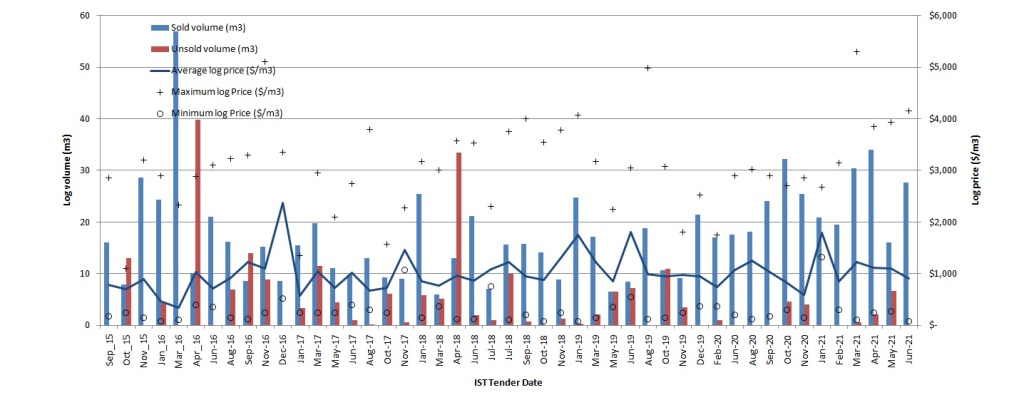

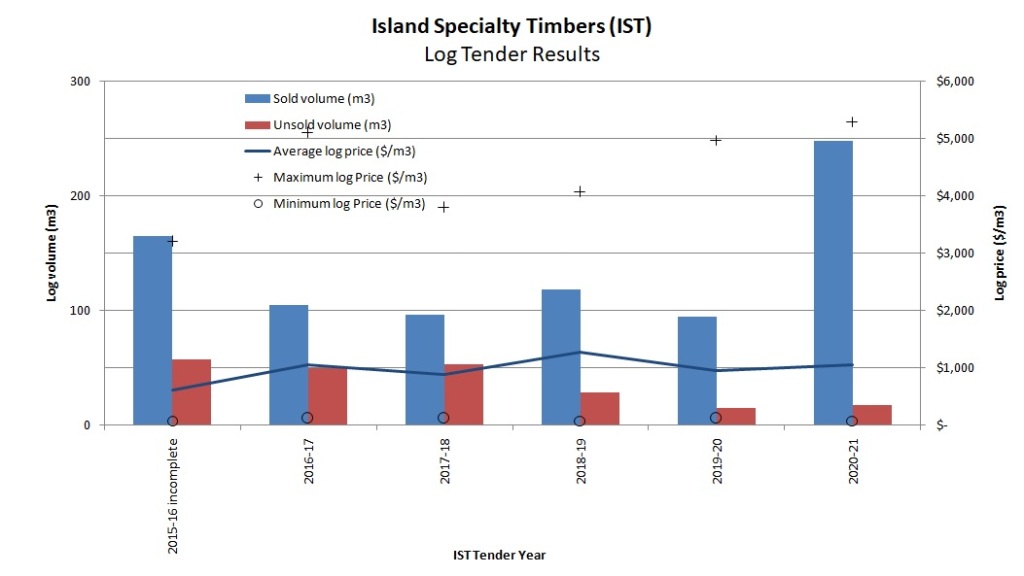

The following chart shows the volume and price summary for all log tenders back to 2015. The price spike in the January 2021 tender was due to this tender being an all Huon pine (Lagarostrobos franklinii) tender.

The tiny volumes and wide variability in species and quality of logs that IST put to tender makes assessing trends over time difficult.

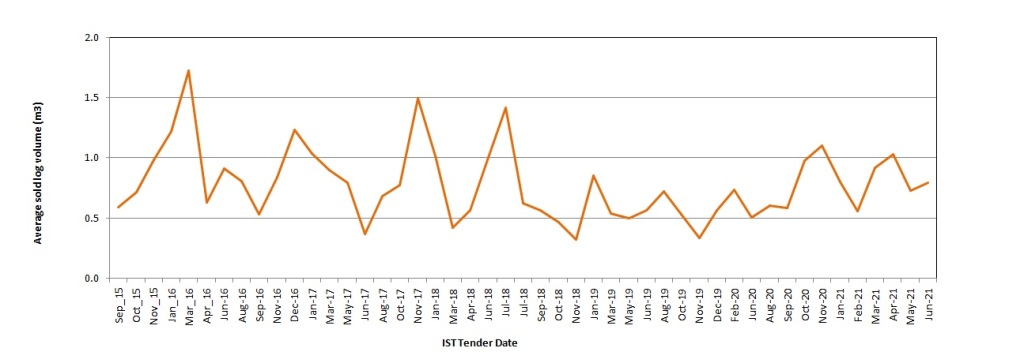

The next chart shows the average volume of the sold logs. Here there is a clear trend of diminishing log size. If it wasn’t for the occasional large eucalypt log IST throws into the tender mix, this trend of diminishing log size would be even more pronounced.

The following 2 charts show the above data summarised by year:

2020-21 was significant for a) the major increase in volume of specialty timbers put to tender, and b) a record unit price set for a single log at IST.

The record unit price of $5,300 per cubic metre was for a Black heart sassafras log at the March 2021 tender. The log was only 2.5 metres long with a volume of only 0.16 cubic metres, so total price was only $850!!

The highest price paid for a single log was at the same March 2021 tender where another Black heart sassafras log of 1.3 cubic metres sold for $5,570.

The main focus of IST tenders is black heart sassafras (Atherosperma moschatum) which can command very high prices for good logs.

https://en.wikipedia.org/wiki/Atherosperma

However the tree is slow growing (500+ years to reach commercial size) and is restricted to rainforest and old growth eucalypt forest, so supplies of this species are dwindling.

Surprisingly the marketplace continues to support the plundering of Tasmania’s last ancient forests!

Five Year Review

Again it is important to recognise that this data represents tiny volumes sold into the small southern Tasmanian market. The results DO NOT represent the wider Tasmanian, Australian or international markets.

The results are also influenced by the fact that IST is NOT a commercial business. Like its parent Sustainable Timbers Tasmania, IST is NOT obliged to make a profit. These rare timber resources are brought to market at taxpayer expense.

Looking at the annual aggregate results of the IST tenders three trends are apparent:

- the maximum price paid for quality wood is increasing; and

- the volume unsold at tender is decreasing. Whether this is due to a) IST becoming better at excluding logs that will not sell, and/or b) increasing demand for quality wood, is unclear. The fact that both the average and minimum prices paid remain steady indicates better log selection rather than increasing demand. Certainly the quality of product put to tender by IST varies enormously.

- the average price paid for quality wood has not changed over the last 5 years, remaining at around $1,000 per cubic metre.

The 7-year trend for plain grain blackwood logs is less clear, but the volumes are microscopic!

In general the prices paid for plain grain blackwood logs have been good, with indications in the last few years of solid price increases.

Since blackwood is the only Tasmanian specialty timber species that can be grown in commercial plantations, this is good news!

Will the Government and the forest industry make use of this valuable positive market information?

Almost certainly not!

Timber supply chain constraints in the Australian plantation sector – The Report

Timber supply chain constraints in the Australian plantation sector – The Report

Back in June last year (2020) I wrote a submission to a Federal Parliament House of Representatives Standing Committee inquiry into plantation log supply constraints in Australia.

Here is the link to the inquiry including the final report and submissions:

https://www.aph.gov.au/Parliamentary_Business/Committees/House/Standing_Committee_on_Agriculture_and_Water_Resources/Timbersupply

As I noted at the time, the Terms of Reference for the inquiry were very typical for the forest industry in Australia, ie. the focus was all on the processors and “jobs”.

And the title for the final report says it all (what a f*****g joke!):

Aussie logs for Aussie jobs

Inquiry into timber supply chain constraints in the Australian plantation sector

Was the inquiry about supporting, encouraging and rewarding profitable tree growers?

Not on your life!

The primary focus of the inquiry was about protectionism and market manipulation.

Don’t get me wrong! I’m happy to support local processing of forest products, but not if it means denying growers the right to open, competitive, transparent markets. Making long term investments, like growing timber, is hard enough without Governments and industry slamming the door in your face.

And this Inquiry and this Report provide absolutely no comfort to existing and potential timber growers, that such market interference wont happen!

So what can I say about the Report?

At least the report is more honest about the current state of the forest industry in Australia than a lot of previous reports.

The picture is rather gloomy!!

The forest plantation sector in Australia is in decline, losing resource and becoming less competitive.

The focus of the report is on commodity wood (pine and hardwood woodchips), with no mention of high value appearance grade forest products.

If nothing else, I recommend reading the section on Farm Forestry which begins on page 59 of the Report. I don’t agree with everything it says, I do agree that there are significant issues, most of which are not being addressed.

One curiosity is the mention in the Report of a “National Farm Forestry Strategy”. Apparently the Federal Government is producing one, but if you Google “National Farm Forestry Strategy” nothing appears!! We have had these strategies before and they have all failed. Let us wait and see!

And the biggest issue for me is the culture and attitude of the forest industry itself, and the “head-in-the sand” attitude of the marketplace!

Happy reading!!

Share this:

Like this:

Related